Steel Products

March 26, 2021

Steel Hedging 101 Workshop: How to Protect Against Market Risk

Written by John Packard

Would you like to learn how to protect your business and minimize risk associated with unfavorable price changes, by figuring out what exactly is meant by “hedging a position”?

Steel Market Update can help to demystify hedging so you can quickly gain a concrete understanding of hedging basics. You will also learn about terminology, market structure, and how different risk strategies work for the flat rolled steel market.

The Steel Hedging 101: Introduction to Managing Price Risk Workshop will be run virtually on March 30-31.

This workshop will help you to understand:

- What “hedging” is and why so many companies do it

- What makes hedging in steel different versus other commodities

- The structure of the market and the mechanics of how trades are executed

- The costs and risk involved

Led by our hedging and metals expert, Spencer Johnson of StoneX, this workshop will benefit anyone who is looking for a concise introductory or refresher course.

You can attend the Steel Hedging 101 Workshop for just $1,250 per person. Don’t forget, SMU/CRU subscribers can save $100 plus an additional $100 per person for companies who register two or more people for the same workshop

About the event Schedule Instructors Delegates Register Book now

Agenda at a glance:

Introductory Hedge Concepts

- Why Hedge?

- Hedge Practices

- Facilities Futures/OTC Markets

- Understanding Risk

Structure of Trading

- Margin

- Clearing

- Settlements

Structure of Trading Terminology

(Language/Definitions of Futures Trading Concepts)

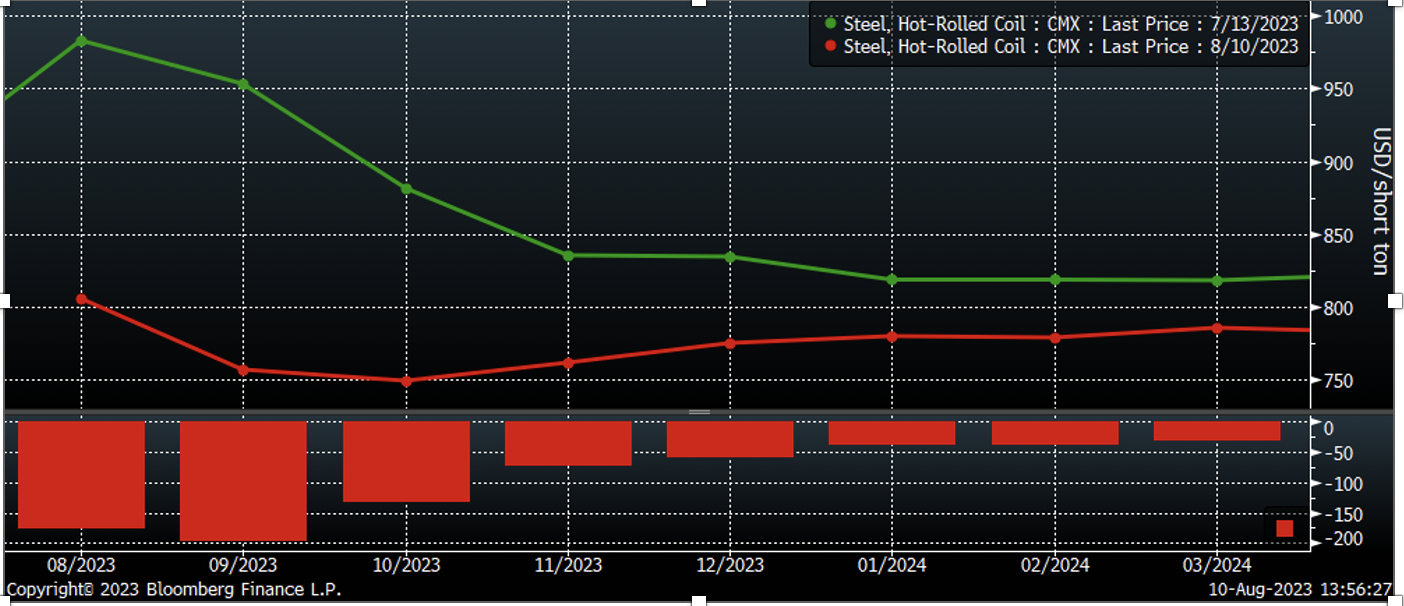

- Forward Curves and Current Markets

- Backwardation vs. Contango Markets

CRU to Speak on HRC Index

- CRU’s methodology

- How people use CRU U.S. Midwest Hot-rolled Coil Index

CME – What are futures and how does the exchange work

Futures / Swap Hedge Strategies

- Life of the Hedge from conception to completion

- Step One – Financing the trade

- Step Two – executing the trade

- Step Three – clearing the trade

- Step Four – settling the trade

- Ongoing Step – adjusting for basis risk

Practical Hedge Examples

- Vanilla Inventory Hedge

- Arranging a Fixed Price Sale

- Hedging a Forward Purchase

- Spread Trading

- Arbitrage

Next Steps

- Examples

- Opening an Account

- Costs to Trade

- Selecting a Broker, Bank, Etc.